About cryptocurrency trading

Introduction

A cryptocurrency is a virtual or digital currency protected by encryption, making counterfeiting or double-spending practically impossible. Several cryptocurrencies use blockchain technologies to create autonomous networks—a decentralized ledger maintained by a diverse computer network. The fact that cryptocurrencies are often not produced by the central body makes them potentially impervious to political intrusion or manipulations About cryptocurrency trading.

Read this: Ultimate tips to clean your home

About cryptocurrency

Cryptocurrency is a digitized payment mechanism that does not depend on banks for transaction verification About cryptocurrency trading. A peer-to-peer transaction system allows anybody to pay and receive money About cryptocurrency trading. Cryptocurrency payments exist primarily as digital contributions to an electronic database identifying particular transactions rather than as tangible currency transferred around and traded in the physical world. Transactions involving bitcoin funds are documented in an open ledger. Digital wallets are where cryptocurrency is kept About cryptocurrency trading.

The term “cryptocurrency” refers to the use of encryption to authenticate transactions. It implies that specialized coding is required to store and transport bitcoin data among wallets and public ledger accounts. Encryption’s goal is to ensure privacy and stability About cryptocurrency trading.

Bitcoin was the very first cryptocurrency and is still the most well-known today. Almost all of the investment in cryptocurrencies is speculative, with investors often boosting prices About cryptocurrency trading.

How does it work?

Cryptocurrencies operate on the blockchain, a public distributed database that keeps track of all transactions maintained and retained by currency owners About cryptocurrency trading.

Mining is a technique which uses computer energy to solve complex mathematical challenges which earn coins to construct cryptocurrency bits. Users may also purchase the currencies from intermediaries and use encrypted wallets to preserve and transact them About cryptocurrency trading.

You don’t possess anything concrete if you hold bitcoin. Everything you have is a credential which enables you to transfer a file or a unit of measurement from one individual to the next without the assistance of a third party About cryptocurrency trading.

Whereas Bitcoin has been present since 2009, cryptocurrencies or advanced blockchain technologies are still developing in the financial perspective, with additional usage planned in the long term. Bonds, stocks, or other financial instruments can be exchanged using the technology About cryptocurrency trading.

Examples

There are several cryptocurrencies. Amongst them, the most well-known are:

Bitcoin

Bitcoin was created in 2009 and was the first cryptocurrency and is now the most widely traded. Satoshi Nakamoto created the currency, which is commonly assumed to be a pseudonym for groups or individuals that specific identity is secret About cryptocurrency trading.

Ethereum

Ethereum, created in 2015, is a blockchain network with its own cryptocurrency known as Ether (ETH) or Ethereum. After Bitcoin, it became the most widely used cryptocurrency About cryptocurrency trading.

Litecoin

The currency is the most identical to bitcoin. However, it has evolved quicker to build new technologies, such as speedier transactions and procedures to provide for more transactions About cryptocurrency trading.

Ripple

Ripple, which was launched in 2012, is a decentralized ledger platform. Ripple may be utilized to track more than simply financial transactions. It was developed in collaboration with numerous banking and other financial entities About cryptocurrency trading.

To differentiate them from the original, non-Bitcoin cryptocurrencies are referred to as “altcoins.”.

Read this: Best Indoor Garden Ideas

Can anyone create a cryptocurrency?

Anyone can create a cryptocurrency. However, it takes time, effort, and other assets to lead to considerable technical skills About cryptocurrency trading.

The significant possibilities are to build your own blockchain, enhance a current blockchain, create a coin on an existing blockchain, or hire a blockchain programmer About cryptocurrency trading.

The easiest part is creating a cryptocurrency. Preserving and developing it over the period is frequently more difficult About cryptocurrency trading.

Employing a blockchain development business allows you to build a new currency or token through any level of customization About cryptocurrency trading. Many blockchain-as-a-service (BaaS) businesses exist to construct and operate new blockchain platforms and cryptocurrencies About cryptocurrency trading.

Some BaaS providers create bespoke blockchains, whereas others rely on their current blockchain architecture. You may potentially collaborate with a BaaS provider to develop a highly customized coin on an existing blockchain network. Amazon Web Services, Microsoft Azure, ChainZilla, and Blockstream are among the most well-known BaaS providers About cryptocurrency trading.

Can I create my own cryptocurrency?

A new cryptocurrency may be created by either constructing a new blockchain with a coin or shelling a current one and producing a token. Many courses on how to be a cryptocurrency developer may be found online, but they all demand basic coding abilities and a thorough grasp of blockchain About cryptocurrency trading.

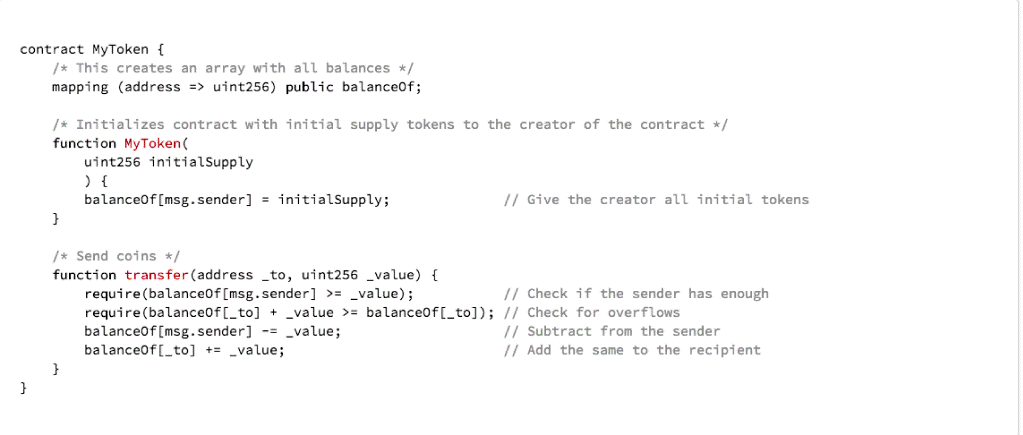

Here is an example of creating a cryptocurrency;

The process of understanding how to establish a cryptocurrency will be incomplete without an instance. The code required to create a unique token might be rather tricky. However, the architecture of a primary cryptocurrency or token is shown below About cryptocurrency trading. It will assist you in making your customized Ethereum token.

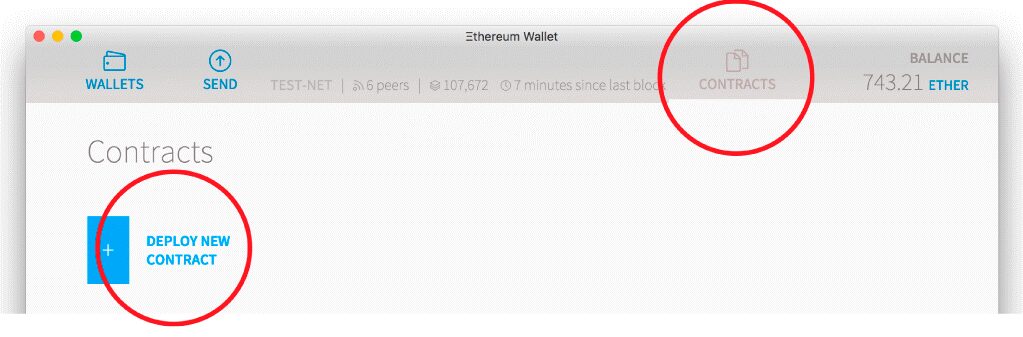

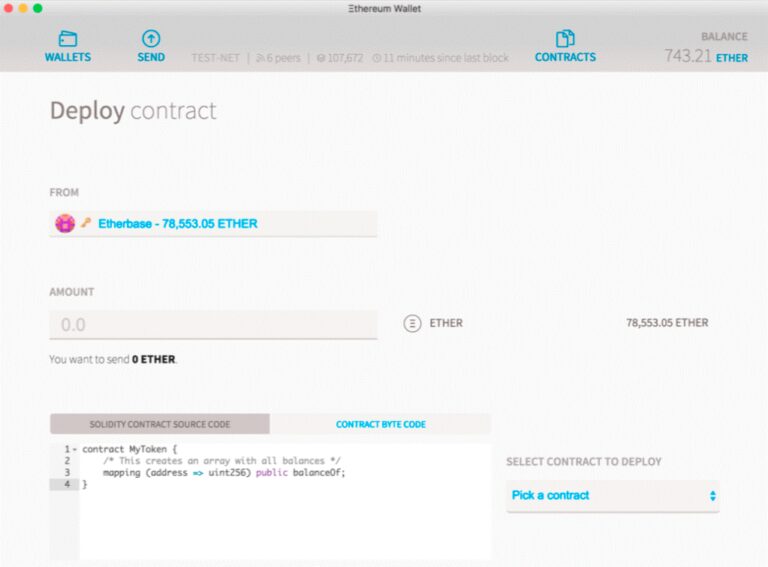

To generate your cryptocurrency, utilize the ETH wallet app, which may be accessed using a search engine. Once you launch the wallet application, you will view a button in the upper right-hand corner, as shown below, “Deploy New Contract” click it About cryptocurrency trading.

When you click, a Solidity Contract Source Code option will pop up. Enter the below code in the given field that pops up.

contract MyToken {

/* This creates an array with all balances */

mapping (address => uint256) public balanceOf;

}

The phrase “mapping” means for an associatory array, which links balances with addresses. All addresses are written in hexadecimal. The word “public,” which is highlighted, signifies that anybody could view the balance. Your interface should appear once you add the Solidity field’s code section.

It, therefore, does not imply that your coin has been produced. What you have to do now is add additional code to the Solidity code field behind line 4, as seen below:

{

function MyToken() {

balanceOf[msg.sender] = 21000000;

}

The initial quantity of tokens would be 21 million. Furthermore, you may change this sum to everything you admire. Let’s take a look at the application’s right-hand side. When you click “Select Contract to Deploy,” a drop-down menu will appear. Click “MyToken.”.

Here, you can add, pay or receive transactions.

Pros of cryptocurrency

Although cryptocurrencies are a relatively new creation (Bitcoin, for example, was founded in 2009), they are unquestionably here to belong, with all their advantages. From the possibility of large profits to 24-hour trading on ultra-secure, open architecture, the realm of cryptocurrency has a lot to offer—if you access it About cryptocurrency trading.

There are over 10,000 cryptocurrencies on the marketplace, each with unique characteristics. However, all cryptocurrencies have several features, including their propensity for abrupt price increases (and decreases). Prices are determined mainly by the supply of coins from miners and buyers’ demand for them. So, these supply-demand patterns could lead to considerable profits. The price of Ethereum, for instance, nearly quadrupled from June 2020 to November 2021—a windfall for those who got in early.

Some of the most significant advantages of cryptocurrencies are not associated with the currencies themselves but with the system to support them. The blockchain is a decentralized data-storage database that keeps track of every transaction it makes. When an entry is made on the blockchain, it cannot be deleted. Furthermore, because the blockchain is distributed decentrally among several systems, no hacker could acquire the entire system at once; any information contained in it is secure for good.

Our financial system is primarily based on third-party intermediaries that handle transactions. It implies that whenever you conduct a transaction, you’re putting your faith in one or more of such intermediaries—and the early-2000s downturn caused many people to rethink when it was a brilliant idea. Blockchain technology and cryptocurrency provide an alternative. They are accessible to anybody, allowing you to participate in the financial system and conduct transactions without mediators.

Another benefit cryptocurrencies have over banks is now that cryptocurrency markets are constantly open. You don’t have to rely on the NYSE, NASDAQ, or any other exchange to open trading that day if you want to purchase, trade, or sell cryptocurrency. It has had such an influence that traditional stock exchanges are investigating the possibility of trading equities outside of regular banking time, though this may be some time away. As a result, crypto may be the ideal option for entrepreneurs who are constantly on the move to create returns beyond the conventional workdays.

As cryptocurrencies aren’t connected to a particular currency or country, their value indicates worldwide demand instead of local inflation. So, what about the inflation of cryptocurrencies? To the most extent, as an entrepreneur, you can relax. Because the quantity of coins is limited, the amount accessible cannot escalate out of line, resulting in no inflation. Some currencies (such as Bitcoin) get an ultimate cap, while others (such as Ethereum) have a yearly cap, so in this case, this strategy holds inflation at bay.

Cons of cryptocurrency

That’s a lot of glitzes, but is the future of cryptocurrencies quite so bright? Let’s look at a few of the disadvantages. Some are readily handled, while others are not—but it is always beneficial to hold them in hand About cryptocurrency trading.

It might take some time to understand cryptocurrency. If you aren’t a digital native, the notion of cryptocurrencies (like the blockchain) might feel foreign. And attempting to engage in anything you don’t fully comprehend is a danger in and of itself. Several internet tools are accessible to assist you (such as N26’s web blogs on crypto). However, you will still need to fully devote time to comprehend the benefits and drawbacks of investing in bitcoin fully.

Whereas the cost of a cryptocurrency can skyrocket to dizzying heights (with attendant rewards for investors!), this can collapse to terrible lows instantly. As a result, if you’re seeking consistent profits, that may not be the ideal choice. The cryptocurrency market is built on anticipation, and its tiny scale puts it more subject to price volatility. This, in turn, might have a negative impact on the worth of coins, and it’s one of the real downsides of cryptocurrencies.

Although cryptocurrencies have grown in prominence, it’s essential to realize that they’ve been around for over a decade. The notion became widely known after publishing a white paper on Bitcoin in 2008. On the other hand, stock markets may trace their roots back millennia. For instance, the London Stock Exchange was established in 1801. For centuries, gold was a reliable store of wealth. But what about cryptocurrencies? No one thinks about what will happen to cryptocurrencies throughout the coming years, and you must be daring to invest in such new oceans.

You can be excused for believing that digital currencies function at breakneck speed—and, to some extent, they do. However, at some point, they come into serious difficulties that make massive implementation impossible. Cryptocurrency providers acknowledge this is a problem, with Ethereum developers claiming that the blockchain has hit “certain capacity restrictions”, which slow the pace at which payments may be completed. This may be an unpleasant process for transaction parties, let alone the possible financial penalties.

Cryptocurrencies may not have the hazards associated with employing central intermediaries. However, that doesn’t imply they’re fully secure. As a cryptocurrency holder, you risk losing the secret key that allows you to unlock your coins and all of your assets. Then there’s phishing, hacking, and all other hostile attempts to acquire control. It is something professional investors are aware of, but novice investors seem more capable of falling victim to such traps.

Read this: Cheap decorating ideas for Party

Sum Up

There is no single cryptocurrency that is significantly superior to the others. It all depends on personal choice, although there are a few things to watch About cryptocurrency trading. Consider your risk tolerance; can you afford to lose a significant portion of your investments if the worth of your selected currency falls? Are you utilizing the currency to create profits, or do you hope to use it to purchase items? Is it only about the income, or do you want to invest in a currency that will have a more significant environmental or social influence? One straightforward way is to select the leading position, Bitcoin. It is the first cryptocurrency, including the one with the broadest knowledge base About cryptocurrency trading.